Market insights: Examples from our chemical industry practice

The Chinese paint and coating markets will continue to demonstrate superb growth in the future

China is now in a league of its own in terms of its position in the worldwide paint sector, with paints and coatings production and demand likely to exceed 4 million tonnes this year. The Chinese paint and coating markets will continue to demonstrate superb growth in the future, with the architectural and automotive sectors growing at about 18-20% pa. All parts of the construction sector are booming, and growth in public and commercial transport is powering ahead of the automobile market.

The Chinese coating industry has developed from an unnoticeable small industry into a vigorous industry, and leaps to the world’s third biggest coating production country, only inferior to United States and Japan in output.

As an important constituent of the four big chemical construction materials, the construction coating is widely used in the decoration and fitting up of buildings, its function is gradually outstanding. In the last few years, with the high speed development of the national economy and the urban construction, under the impetus of the big development of west China and the Olympics stadiums and gyms construction, the number of important projects and civil houses is gradually rising, in addition to the publish of related policies, the Chinese construction coating industry will meet the unprecedented development opportunity.

Chinese construction coating’s development tendency is the same as that of the world--the certain development towards high performance and functional construction coating. The construction coating directly relates to human’s health and living environment, from the aspect of development tendency, the construction coating will develop towards the direction of environmental protection and low toxicity.

The Chinese furniture industry has a glorious history, but the modern furniture industry is still at a quite backward position. The quality of wooden article coating is not high and the grade is low, which seriously affects the enhancement of the quality of Chinese furniture and its competitive ability in the market. With the improvement of people’s demand for life quality, the demand for middle and high grade furniture will surely increase; this also provide a good development opportunity and a big growth space for the development of the Chinese wooden article coating market.

At present the Chinese wooden article coating market mainly give first place to polyurethane coating.

Water coating occupies a very small proportion, it has a big development space, and moreover it also will be the mainstream of the development of future wooden article coating. Seen from the international coating market, water coating will gradually substitute for traditional coating and occupy the major part of the market share. Chinese wooden article coating producers concentrate mainly in the Pearl River delta area, most of them are privately operated enterprises, the market share of state-owned enterprises and foreign capital enterprises is only about 25%. The enterprises’ scale is small, the competitive ability is weak.

Demand for protective coatings in the US will grow 4.6 percent annually through 2009. Advances will be driven by transportation equipment, machinery, electronics and structural metal applications. Corrosion control coatings will remain dominant while fire resistant, anti-wear and conformal coatings grow the fastest.

USA: Significant market chances for chemical sensors see strong gain

US demand to reach $4.1 billion in 2009

Demand for chemical sensors in the US will expand at a rapid 7.3 percent annual pace to $4.1 billion in 2009, buoyed by continued strong demand for biosensor products in the medical and diagnostic industries, and increased spending on public safety and security in the face of a potential biological or chemical terrorist attack. Other markets such as environmental monitoring and industrial processing will also experience healthy gains, though not as fast as medical and diagnostics.

Aging US population, terrorism concerns to spur demand

Over the next decade the United States will experience a dramatic shift in population demographics as the number of Americans over the age of 55 expands over twice as fast as the overall population. The number of chronic medical conditions will expand even faster as a manifestation of increased age related incidence rates in concert with poor long term nutritional and physical activity habits by the baby boomer generation. These medical conditions will need to be diagnosed, boosting chemical sensor demand for established diagnostic tests, and driving the development of new sensors and diagnostic tests that can facilitate patient management of non-critical conditions.

Significant public concern over the potential for a chemical or biological terrorist attack has resulted in a rapid increase in funding for chemical detection research and development. New chemical sensor systems targeted at biological pathogens, explosives and toxic chemicals will benefit from strong demand by public facilities and the military. Demand will also arise from private companies seeking to minimize risk exposure by protecting important facilities and key personnel locations.

While trailing the growth of the medical and diagnostic markets, chemical sensor demand in environmental monitoring will continue to see strong gains as urban expansion contributes to air and water quality concerns around the country, and new rules governing emissions from power plants in the eastern US, as well as limiting emissions from heavy duty diesel trucks, create new opportunities. Similarly, industrial process sensor demand will post healthy advances, though gains will be restrained by the continued shift of the US economy away from its historical manufacturing base.

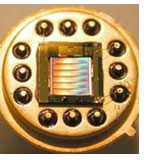

Biosensors to remain largest sensor type

Biosensors, due to their heavy use in the medical and diagnostic market, will continue to be the largest sensor type, and, along with optical sensors, will achieve some of the fastest growth. Optical sensors will benefit from their noninvasive nature, and high sensitivity and accuracy. Electrochemical and semiconductor sensors will achieve slower gains due to their heavier use in the slower growing industrial process market.